How to Call Your US Bank From Overseas: All Numbers & Costs

Complete guide to calling US banks internationally. All major bank numbers (Chase, BofA, Wells Fargo, Citi, Capital One) with wait times, departments, and cheapest calling options.

Your debit card just got declined at a restaurant in Barcelona. Or perhaps you received a fraud alert text while checking into your Tokyo hotel. Maybe you simply need to verify a large wire transfer from your temporary office in London.

Whatever the reason, you need to contact your US bank immediately—but you're thousands of miles away.

Here's the problem: those familiar 1-800 numbers printed on the back of your card don't work from most international locations. Hotel phone calls cost $2-5 per minute. Your mobile carrier charges $1-3 per minute for international calls. And you're already stressed about the banking issue itself.

This complete guide gives you every number you need, tells you exactly what to expect when calling, reveals the best times to reach a human quickly, and shows you how to make these calls for pennies instead of dollars.

Let's get your banking sorted, wherever you are in the world.

Why 1-800 Numbers Don't Work Internationally

US toll-free numbers (1-800, 1-888, 1-877, 1-866) only function within the United States and sometimes Canada. These numbers rely on the North American toll-free system, which international phone networks don't support.

When you dial a 1-800 number from London, Tokyo, or Mexico City, you'll typically hear one of these messages:

This happens because toll-free numbers use special routing codes specific to US telecommunications infrastructure. International carriers simply don't have the systems to connect these calls.

Banks created alternative international contact numbers specifically for customers calling from abroad. These numbers use standard international dialing codes and work from any country.

Save yourself frustration: before you travel, add your bank's international number to your phone contacts.

Major US Banks International Contact Numbers

Here are the verified international customer service numbers for major US banks, current as of January 2025. These numbers work 24/7 from any country.

Chase Bank

Main International Number: +1-713-262-3300

Collect Call Number: +1-813-432-6122

Credit Card International: +1-713-262-3300

Debit Card Lost/Stolen: +1-713-262-3300

Hours: 24 hours, 7 days a week

Chase's international line handles all customer service needs: account access issues, card problems, fraud reports, transaction verifications, and general banking questions. Representatives can unlock accounts, activate cards, and verify your identity remotely.

Bank of America

Main International Number: +1-315-724-4022 (accepts collect calls)

Credit Card International: +1-302-738-5719

Debit Card International: +1-315-724-4022

Hours: Monday-Friday 7am-10pm ET, Saturday-Sunday 8am-5pm ET

Bank of America explicitly accepts collect calls to this number when you identify yourself as a customer. This means the bank pays for the call instead of you. Simply call your country's international operator and request a collect call to +1-315-724-4022.

Wells Fargo

Main International Number: +1-775-335-1115

Credit Card Services: +1-775-335-1115

Debit Card Services: +1-775-335-1115

Hours: 24 hours, 7 days a week

Wells Fargo also provides country-specific toll-free numbers in many locations. Check their international access codes page before calling. However, the +1-775 number works universally if your country's specific number doesn't connect.

Citibank

Main International Number: +1-210-677-3789

CitiPhone International: Use country-specific numbers on their website

Credit Card International: +1-210-677-3789

Hours: 24 hours, 7 days a week

Citibank operates globally and offers numerous country-specific contact options. The +1-210 number serves as the universal backup when local numbers aren't available or don't work properly.

Capital One

Main International Number: +1-804-934-2001 (accepts collect calls)

Credit Card International: +1-804-934-2001

Hours: 24 hours, 7 days a week (automated), representative hours vary

Capital One accepts collect calls from international customers. Give your name as "Capital One Customer" when the operator asks.

US Bank

Main International Number: +1-800-872-2657 (may not work internationally)

Business Credit Cards: +1-701-461-0346 (collect)

Hours: 24 hours for automated, representative hours 8am-11pm ET

US Bank's international support is less developed than larger national banks. The collect number for business credit cards often works when other numbers don't.

Cost Comparison: How Much You'll Actually Pay

The same 10-minute call to your bank costs wildly different amounts depending on how you make it. Here's what you'll actually spend:

Real-World Cost Examples

Scenario 1: Card blocked in Paris

You need to call Chase to unlock your card. The call takes 8 minutes to reach a representative, verify your identity, and resolve the issue.

Savings with browser calling: $11.96-$39.96

Scenario 2: Fraud alert in Bangkok

Bank of America texts you about suspicious activity. You need to verify legitimate charges and clear the fraud hold. Call duration: 12 minutes.

Savings with browser calling: $5.94-$59.94

Scenario 3: Wire transfer verification in London

You're buying property and need Wells Fargo to verify and process an international wire transfer. Multiple holds, verification steps: 25 minutes total.

Savings with browser calling: $37.37-$124.87

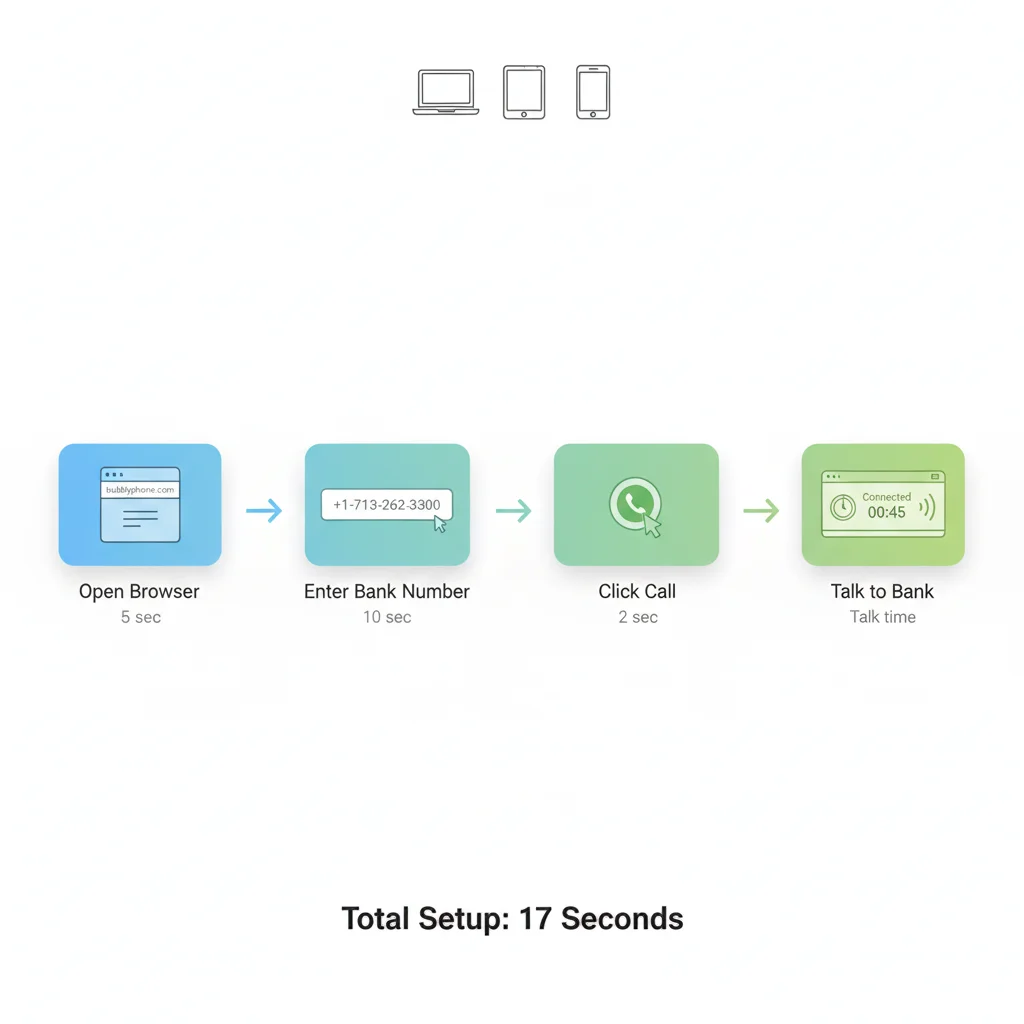

How to Call Your Bank: Step-by-Step Process

Method 1: Browser Calling (Recommended)

Cost: $0.005-$0.02 per minute

Setup time: 15 seconds

Works from: Anywhere with internet

Step 1: Open your web browser (Chrome, Safari, Firefox, or Edge work)

Step 2: Visit BubblyPhone.com

Step 3: Grant microphone permission when prompted (click "Allow")

Step 4: Enter your bank's international number in full format

Example: +17132623300 for Chase

Step 5: Click the call button

Step 6: Talk normally when connected (typically 2-3 seconds)

The call quality matches or exceeds traditional phone calls because browser calling uses HD voice technology. You'll pay only for minutes used, with costs appearing in real-time during your call.

Method 2: Collect Call (Free for You)

Cost: $0.00 (bank pays)

Setup time: 2-3 minutes

Works from: Most countries, requires operator

Step 1: Find your country's international operator access code

Step 2: Dial your country's international operator

Step 3: Tell the operator: "I need to make a collect call to the United States"

Step 4: Provide the bank's international number

Step 5: When asked for your name, say: "[Bank Name] Customer" or your actual name

Step 6: Wait while the operator connects you and the bank accepts charges

Not all banks accept collect calls. Bank of America and Capital One explicitly do. Others may accept on a case-by-case basis.

Method 3: Direct Dial (Traditional)

Cost: Varies by carrier ($0.50-$3.00/minute)

Setup time: Immediate

Works from: Anywhere with phone service

Step 1: Check your mobile plan's international calling rates

Step 2: Dial the international exit code for your location

Step 3: Dial the full bank number including +1 country code

Example: 00-1-713-262-3300 or +1-713-262-3300

Step 4: Wait for connection (may take 5-10 seconds)

This method is convenient but expensive. Use it only when internet isn't available or for very brief calls.

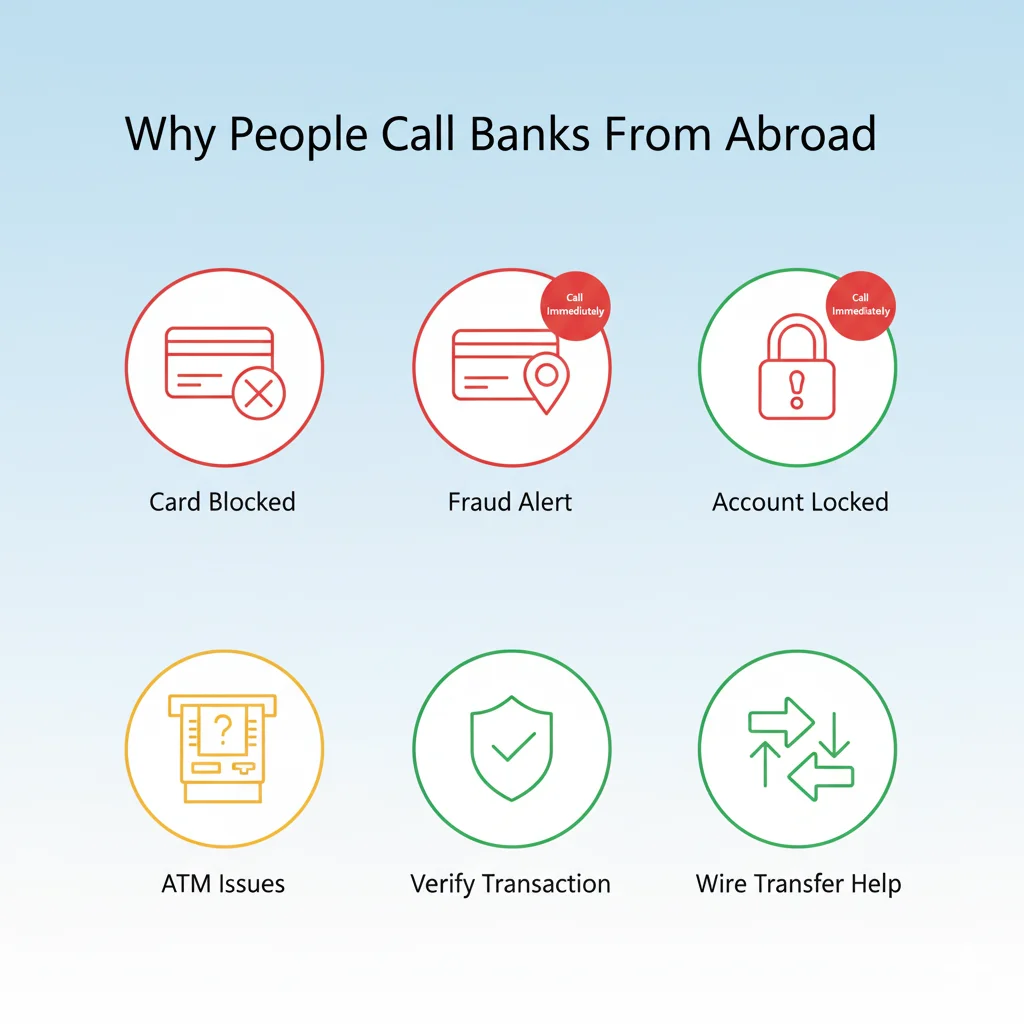

Common Situations: When You Need to Call

Understanding why most people call helps you prepare the right information before dialing.

Card Blocked or Declined

Why it happens: Banks use automated fraud detection. International transactions, especially in countries you haven't visited recently, trigger blocks.

What to say: "My card was declined at [location] and I need it unblocked for legitimate use."

Information needed:

Expected resolution time: 5-10 minutes

Most blocks resolve quickly once you verify your identity and confirm you're traveling. Representatives can immediately remove the fraud hold.

Fraud Alert Verification

Why it happens: Suspicious transaction patterns, large purchases, or transactions from risky merchants.

What to say: "I received a fraud alert and need to verify which transactions are legitimate."

Information needed:

Expected resolution time: 10-15 minutes

You'll go through recent transactions one by one. The representative marks each as legitimate or fraudulent. Legitimate charges get approved. Fraudulent charges get reversed and you'll receive a new card.

Account Access Locked

Why it happens: Too many failed login attempts, suspicious login location (VPN), or security verification requirements.

What to say: "I'm locked out of my online banking and need to regain access."

Information needed:

Expected resolution time: 5-8 minutes

Representatives can reset your online banking access, send you a temporary password, or verify your identity for immediate access. Some banks require you to set up two-factor authentication during this call.

ATM Problems

Why it happens: Card retained by machine, withdrawal declined, incorrect amount dispensed, or machine malfunction.

What to say: "The ATM at [location] retained my card" or "I withdrew $200 but only received $100."

Information needed:

Expected resolution time: 10-20 minutes

For retained cards, banks can deactivate the card and expedite a replacement to your overseas address. For incorrect amounts, they'll file a dispute and investigate with the ATM operator. Resolution may take 5-10 business days, but you'll receive provisional credit in many cases.

Wire Transfer Issues

Why it happens: Large transfers require verification, recipient information errors, or security holds on international wires.

What to say: "I need to verify/send an international wire transfer."

Information needed:

Expected resolution time: 15-30 minutes

International wire transfers involve multiple verification steps. Representatives need to confirm your identity, verify recipient information, explain fees, and sometimes get manager approval for large amounts. Have all recipient banking details ready before calling.

Lost or Stolen Card

Why it happens: Pickpocketing, theft, or simply misplaced during travel.

What to say: "My card was lost/stolen and I need it deactivated and replaced."

Information needed:

Expected resolution time: 10-15 minutes

Representatives immediately deactivate the lost card to prevent unauthorized use. They'll ask about recent transactions to identify potential fraud. Replacement cards typically take 5-7 business days for standard delivery, 2-3 days for expedited (extra fee). Some banks offer emergency card services in major cities worldwide.

Which Department Do You Need?

Large banks route calls to specialized departments. Knowing which one you need saves transfer time.

Card Services Department

Handles:

When to request: Say "card services" or "I have a credit/debit card issue"

Fraud Department

Handles:

When to request: Say "fraud department" or "I need to report unauthorized charges"

Important: Fraud departments operate with heightened security. Expect more rigorous identity verification.

Online Banking Support

Handles:

When to request: Say "online banking" or "I can't access my account online"

Customer Service (General)

Handles:

When to request: Start here if unsure which department you need. They'll transfer you to the right place.

Wire Transfer Department

Handles:

When to request: Say "wire transfer department" or "I need to send money internationally"

Best Times to Call: Avoid Long Waits

Bank call volume varies dramatically by day and time. Strategic timing cuts your wait from 20+ minutes to under 10.

Best Days to Call Each Bank

Chase

Bank of America

Wells Fargo

Citibank

Capital One

Time Zone Considerations

Most US banks operate customer service centers in Eastern Time (ET) or Pacific Time (PT). When calling from abroad, convert to local time:

From Europe: Call during afternoon/evening your time (morning US time)

From Asia: Call during evening/night your time (morning US time)

From Australia: Call during late night/early morning your time (morning US time)

From South America: Call during morning your time (aligns closely with US time zones)

Early morning US time consistently offers shortest wait times across all banks because:

Preparing for Your Call: What to Have Ready

Having information ready before calling dramatically reduces call duration and frustration.

Essential Information (Always Needed)

☐ Full account number or last 4 digits

☐ Your full legal name

☐ Date of birth

☐ Last 4 digits of SSN or TIN

☐ Current phone number (where bank can reach you)

☐ Email address on account

☐ Current physical location (country and city)

Security Questions (Often Asked)

☐ Mother's maiden name

☐ Previous address

☐ Security phrase or word

☐ Answers to custom security questions

Situation-Specific Information

For card issues: ☐ Last 4 digits of card number

☐ Recent transaction amounts and merchants

☐ Date and location of last successful transaction

For account lockouts: ☐ Last successful login date

☐ Typical login location

☐ Recent account activity

For fraud reports: ☐ Unauthorized transaction details

☐ Timeline of when you noticed the issue

☐ Any communication with merchants

For wire transfers: ☐ Recipient's full name and address

☐ Recipient's bank name and SWIFT code

☐ Recipient's account or IBAN number

☐ Transfer amount and currency

☐ Purpose of transfer

Document Access

Take photos or screenshots of these before calling:

Store these securely on your phone. You might need to reference them during the call.

Using BubblyPhone to Save Money

Browser-based calling through BubblyPhone offers the cheapest, most convenient way to reach your bank internationally.

Why BubblyPhone Works Better

No downloads needed: Open your browser and start calling. No app store visits, no storage space used, no installation wait time.

Crystal-clear audio: WebRTC technology delivers HD voice quality that often exceeds traditional phone calls.

Transparent pricing: See exactly what you're paying per minute before you call. No hidden fees, connection charges, or surprise bills.

Works on any device: Your laptop, tablet, and phone all access the same service through a simple URL. No platform limitations.

Instant connection: Calls connect in 2-3 seconds. No dial-through numbers, no callback systems, no complicated setup.

Multiple payment options: Add $5, $10, $25, or $50 in credits. Use only what you need. Credits don't expire.

Actual Costs for Bank Calls

Here's what you'll actually pay for typical bank calls using BubblyPhone:

Quick issue resolution (5 minutes):

Standard support call (10 minutes):

Complex issue (20 minutes):

Extended resolution (30 minutes):

Compare to traditional methods where the same calls cost $10-$150.

How to Use BubblyPhone for Bank Calls

Step 1: Before you travel, visit BubblyPhone.com and test the service

Make a quick test call to verify audio quality and familiarize yourself with the interface. This takes 30 seconds and ensures everything works when you actually need it.

Step 2: Save your bank's international number in your phone contacts

Format: "+1-713-262-3300" with country code

Label: "Chase International" or "Chase - Call from Abroad"

This prevents dial errors during stressful situations.

Step 3: Add calling credits to your BubblyPhone account

$10 provides 500-2,000 minutes depending on destination. More than enough for multiple bank calls during extended travel.

Step 4: When you need to call your bank, open BubblyPhone on any device

Works equally well on your laptop at the hotel, your phone on cafe wifi, or your tablet during a flight with wifi.

Step 5: Enter or paste the bank number and click call

The connection establishes in seconds. Talk normally. The timer shows call duration and cost in real-time.

Step 6: End the call when finished

See the final cost immediately. Credits deduct automatically. No surprise charges, no complicated billing.

Frequently Asked Questions

What if the representative can't hear me clearly?

Poor audio quality usually stems from your internet connection, not the calling service. Switch from wifi to mobile data or move closer to your router. Using headphones with a built-in microphone dramatically improves audio clarity for both parties. If problems persist, hang up and call back—sometimes you'll get a better connection on the second attempt.

Can I call my bank from a country with strict internet restrictions?

Some countries (China, Iran, UAE) restrict VoIP services. Browser calling may not work in these locations. Use collect call methods instead, or try connecting through a VPN before calling. Most major cities have international business centers with unrestricted internet access if your hotel wifi blocks calling services.

Will calling affect my credit score?

No. Calling customer service, even to report fraud or resolve account issues, doesn't impact your credit score. Only actual account activity (late payments, high balances, closed accounts) affects credit scores. Call whenever you need help without worrying about credit consequences.

How do I explain my situation if the representative has never heard of browser calling?

You don't need to explain. From the bank's perspective, your call appears identical to any international call. Representatives see your phone number (or the calling service's number) and connect with you normally. The technology you're using is transparent to them.

What if I'm in a remote location without reliable internet?

Without internet, browser calling won't work. Your options: use the collect call method through a landline, find a location with better connectivity, or use traditional direct dial through your mobile carrier (expensive but functional). Many hotels in remote locations have business centers with computers and landline phones you can use.

Can I call other US numbers using the same method?

Yes. Browser calling through BubblyPhone works for any US number, not just banks. Use it for calling credit card companies, insurance providers, healthcare facilities, family, friends, or business contacts. The same low rates apply to all calls.

What happens if my call disconnects mid-conversation?

Call back immediately using the same number. Most banks keep notes on your call and can quickly resume where you left off. Mention to the new representative: "I was just speaking with someone about [issue] and we got disconnected." They'll access your file and continue helping.

Is it safe to discuss account details over browser calling?

Yes. Browser calling uses the same encryption standards as traditional phone calls and often provides better security. WebRTC technology includes end-to-end encryption. Your conversation is secure from interception. Never call using unsecured public computers, though—use your own device.

Do I need to notify my bank before traveling?

Requirements vary by bank. Most banks no longer require travel notifications because their fraud detection systems automatically recognize traveling patterns. However, setting a travel notification never hurts and may prevent blocks. Set notifications through your bank's website or mobile app before departure.

What if I need to call outside business hours?

Most major banks provide 24/7 international customer service for urgent issues like lost cards or fraud. General account services may have limited hours (typically 7am-10pm ET). Check your bank's specific hours above. For true emergencies (fraud, theft), call anytime—automated systems route urgent calls appropriately.

Emergency Banking While Abroad: Additional Resources

Sometimes calling isn't enough. Here are additional resources for banking emergencies overseas.

Bank Mobile Apps

Most banks offer mobile apps with emergency features:

Download your bank's app before traveling. Set up biometric login (fingerprint or face recognition) so you can access it quickly without remembering passwords.

Embassy and Consulate Banking Services

US embassies and consulates worldwide provide emergency financial services for citizens:

Contact information for every US embassy: travel.state.gov/embassies

Alternative Emergency Funds

Always travel with multiple payment methods:

Keep backup cards in separate locations (hotel safe, hidden pocket, different bag) so one theft doesn't leave you completely without funds.

Wire Transfer Services

If your bank card isn't working and you need emergency funds:

Western Union: Receive money within hours at thousands of locations worldwide. Someone in the US sends money, you pick it up with ID.

MoneyGram: Similar to Western Union with slightly different fee structures and locations.

Wise (formerly TransferWise): Lower fees but requires 1-3 business days. Good for planned transfers, not emergencies.

Have the contact information for one money transfer service saved before traveling.

Avoiding Banking Problems While Traveling

Prevention saves you from needing these emergency calls.

Before You Leave

Notify your bank (even though most say it's optional):

Set up account alerts:

Memorize critical information:

Take photos of:

Store photos securely in encrypted cloud storage or password-protected folder.

While Traveling

Monitor your accounts daily: Check transactions each morning using your bank's app or website. Catch unauthorized charges quickly.

Use ATMs wisely: Withdraw from bank-operated ATMs during business hours when possible. Avoid standalone ATMs in remote areas. Cover your hand when entering PIN.

Protect your cards: Never let your card out of sight during transactions. Don't let merchants take your card to another room. Watch the transaction amount before entering your PIN.

Avoid common mistakes:

Keep emergency contacts accessible: Save bank numbers in phone, email them to yourself, write them in your passport, and take a photo stored on your phone.

Final Checklist: Banking Abroad Preparation

Use this checklist to prepare for international travel:

Two Weeks Before Departure

☐ Test browser calling from your computer

☐ Save international bank numbers in phone

☐ Set travel notifications with all banks

☐ Set up transaction alerts

☐ Update bank's contact information (email, phone)

☐ Photograph all cards and account information

☐ Add calling credits to BubblyPhone account

One Week Before Departure

☐ Verify all cards are activated

☐ Check card expiration dates

☐ Confirm sufficient credit limits

☐ Download bank mobile apps

☐ Test app logins and features

☐ Set up biometric authentication

☐ Print emergency contact numbers (backup)

Day of Departure

☐ Cards packed in separate locations

☐ Phone contacts include international numbers

☐ Know your country's international operator code

☐ Have some local currency

☐ Final account balance check

☐ Verify insurance coverage for lost cards

While Traveling

☐ Check accounts daily

☐ Save receipts from all transactions

☐ Note locations of reliable ATMs

☐ Keep hotel contact information accessible

☐ Monitor email for bank alerts

☐ Document any suspicious activity immediately

Get Help Right Now

Need to call your bank immediately? Here's your quick-start guide:

Step 1: Open BubblyPhone.com in your browser right now

Step 2: Find your bank's number in the list above

Step 3: Enter the complete number with country code

Step 4: Click call and connect in seconds

Step 5: Have your account number and ID ready for verification

Don't let international calling costs add stress to your banking emergency. Browser calling makes it affordable and simple to get help immediately, no matter where you are.

Your card block, fraud alert, or account issue can be resolved in minutes. The bank is ready to help. You just need to reach them efficiently.

Make that call now.

Further Reading

Need more help with international banking and calling? Check out these related resources:

Last updated: November 2025 Bank contact numbers verified November 2025

Ready to Start Calling?

Make international calls from your browser with BubblyPhone. No app needed, instant setup.

Get Started Free